Short Selling

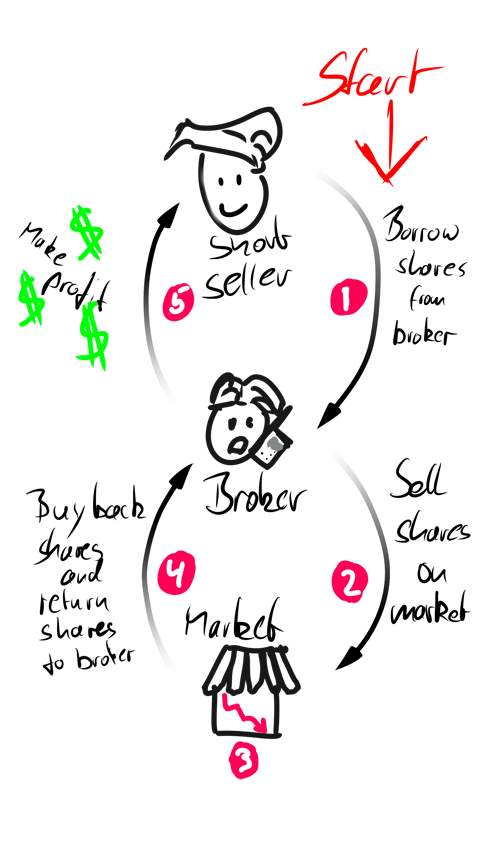

Short Selling is a type of stock market transaction in which an investor bets on a decrease in the price of a stock. In this case, the investor sells stocks that are borrowed from a broker, hoping that the price of the stock will fall in the future. If the price actually drops, the investor can buy the stock back and return it to the broker to realize their profit. The investor profits from a falling price, rather than a rising price as in a traditional stock purchase.

However, short selling is a very risky strategy because the price of a stock can rise indefinitely, and an investor can suffer unlimited losses as a result.

Short selling can also have an impact on individual investors, as it can lower the price of a stock. If many investors bet on a price decline, this can create strong selling pressure and cause the price of the stock to drop. If the price of a company's stock falls, this can also affect the confidence of individual investors in the company and the market as a whole. Individual investors who own shares of the company can suffer losses due to the decrease in the stock price.